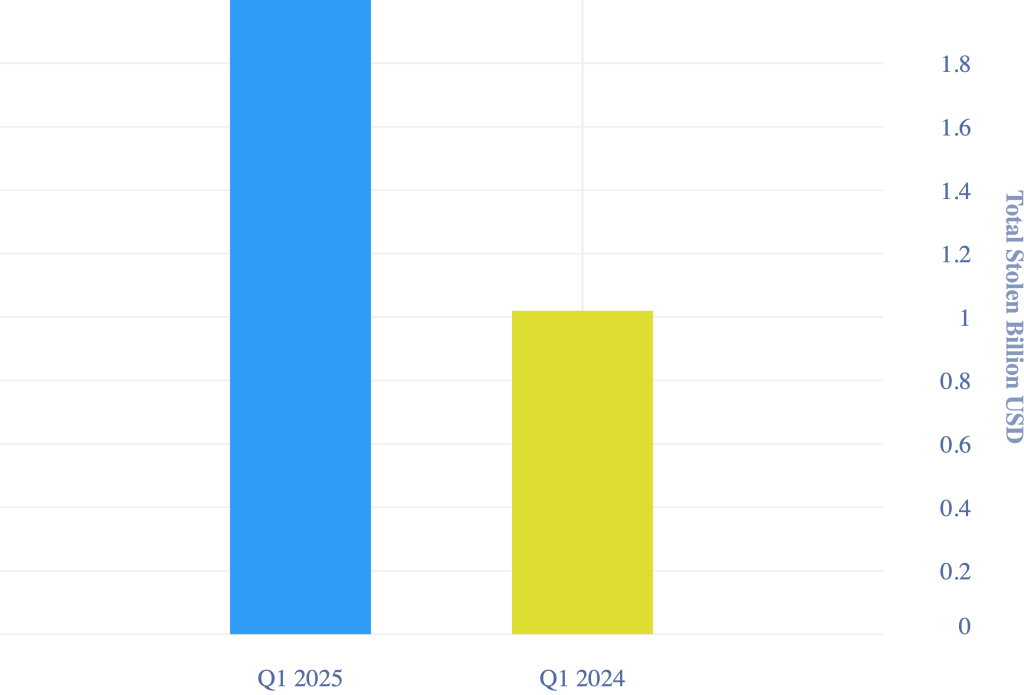

The cryptocurrency industry has been rocked by a sharp rise in cyber thefts, with more than $2 billion stolen in just the first quarter of 2025. Hacken’s Web3 Security Report shows that thefts are up 96% compared to the same period in 2024. This is one of the biggest waves of cybercrime the crypto sector has ever seen.

Analysts suggest that rising geopolitical tensions, macroeconomic instability, and growing sophistication among cybercriminal groups are contributing factors behind this escalation.

High-Profile Breaches Fuel Massive Losses

Among the most devastating attacks was the Bybit exchange hack in February, where cybercriminals managed to steal approximately $1.5 billion worth of Ethereum. This breach was attributed by the FBI to the notorious North Korean cybercrime syndicate known as the Lazarus Group, highlighting vulnerabilities even in established platforms.

The scale of the attack rivals historical breaches like the Mt.Gox hack in 2014 and the FTX collapse in 2022, underscoring how high-profile targets remain susceptible despite advancements in security. A detailed analysis of this incident is available on BlockDefenders’ blog: The Bybit Hack: A Vertical Attack.

Another significant incident involved the $LIBRA cryptocurrency, which fell victim to an elaborate rug pull scam. Endorsed by high-profile figures, including Argentine President Javier Milei, investors saw losses exceeding $87 million after founders abruptly liquidated their holdings, causing an 85% drop in the token’s value.

Exploitation of Weak Security Practices

Reports indicate that the majority of the thefts, around $1.63 billion, were due to inadequate access control measures. Hackers frequently exploited vulnerabilities in multi-signature wallets and lax internal security protocols, demonstrating the pressing need for comprehensive security reforms across the crypto industry.

New Threats and Techniques Emerge

Phishing attacks and social engineering have significantly increased, underscoring the evolving sophistication of cyber threats. One notable example involved attackers impersonating popular wallet providers through spoofed emails, directing users to phishing websites where login credentials and seed phrases were stolen.

Hackers have also leveraged advanced money laundering techniques, including perpetual exchanges and simulated transactions, complicating efforts to trace and recover stolen funds.

Potential Correlation with Bear Market Conditions

Interestingly, this surge in criminal activity may also signal, or contribute to, the onset of a bear market. Historically, increased scams and cyber thefts tend to align with deteriorating investor sentiment.

Moreover, during bearish periods, crypto firms may reduce budgets, including spending on cybersecurity, leading to higher vulnerability. These conditions create an ecosystem ripe for exploitation, especially when combined with the psychological pressure that comes with market downturns. Retail investors, in particular, may act out of fear, seeking quick liquidity, which exposes them to more scams and impulsive decisions. Fear-driven behaviour, combined with high-profile hacks, often drives users to withdraw assets, contributing further to negative price pressure and market contraction.

Historical parallels, such as the sharp increase in ICO frauds before the 2018 crypto winter, support the idea that heightened criminal activity typically correlates with or even foreshadows bearish market trends. While more empirical analysis is needed to confirm a direct correlation, these patterns suggest that rising cybercrime and a declining market could be interlinked in a cycle of mutual reinforcement.

Recommendations for Enhancing Security

Crypto firms must urgently enhance their security frameworks by implementing:

- KYC new users

- Multi-factor authentication and biometric verification

- Regular external security audits

- Use of secure custody solutions like Fireblocks or BitGo

- Real-time transaction monitoring tools such as Valega Chain’s Cryptocurrency Transaction Monitoring

- Multi-party computation (MPC) wallets

Additionally, user education must remain a top priority. Hosting phishing awareness campaigns and providing clear guidance on private key management can significantly reduce the human error component in successful attacks.

The crypto industry’s resilience is under scrutiny as these unprecedented security breaches underline an urgent call to action: Strengthening cybersecurity must become a paramount priority to sustain investor trust and support the continued growth of digital assets.