In March 2025, the global crypto community witnessed a major enforcement action as U.S. and European authorities took down Garantex, a Russia-linked cryptocurrency exchange accused of facilitating money laundering, ransomware payouts, and darknet market activity. Just weeks after the domain seizure and public takedown, a suspicious exchange emerged under a new name: Grinex.

This article dives deep into how Garantex rebrand and bypass sanctions, why this matters for global crypto regulation, and how investigators can spot and stop these evasive tactics.

Who was Garantex?

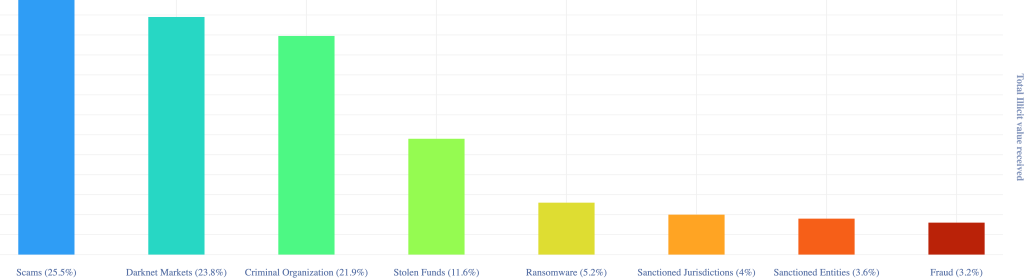

Founded in 2019 and operating primarily out of Russia, Garantex marketed itself as a fast and reliable crypto trading platform. However, forensic firms and regulators have discovered extensive evidence linking the exchange to illicit transactions, including over $100 million in proceeds from darknet sales, ransomware operations, and fraud rings. Despite being sanctioned by the U.S. Treasury’s Office of Foreign Assets Control (OFAC) in 2022, Garantex continued operations until its infrastructure was finally seized in March 2025.

The Takedown: Sanctions and seizures

On March 6, 2025, Garantex’s domain was officially seized, and law enforcement froze key assets. The coordinated action involved agencies including the FBI, Europol, and blockchain intelligence providers. The seizure banner placed on their website served as a warning: the crypto ecosystem would no longer tolerate safe havens for laundering criminal proceeds.

The Grinex rebirth

Within weeks, analysts noticed a new exchange, Grinex, with eerily familiar branding, UI/UX, backend structure, and even customer support contacts.

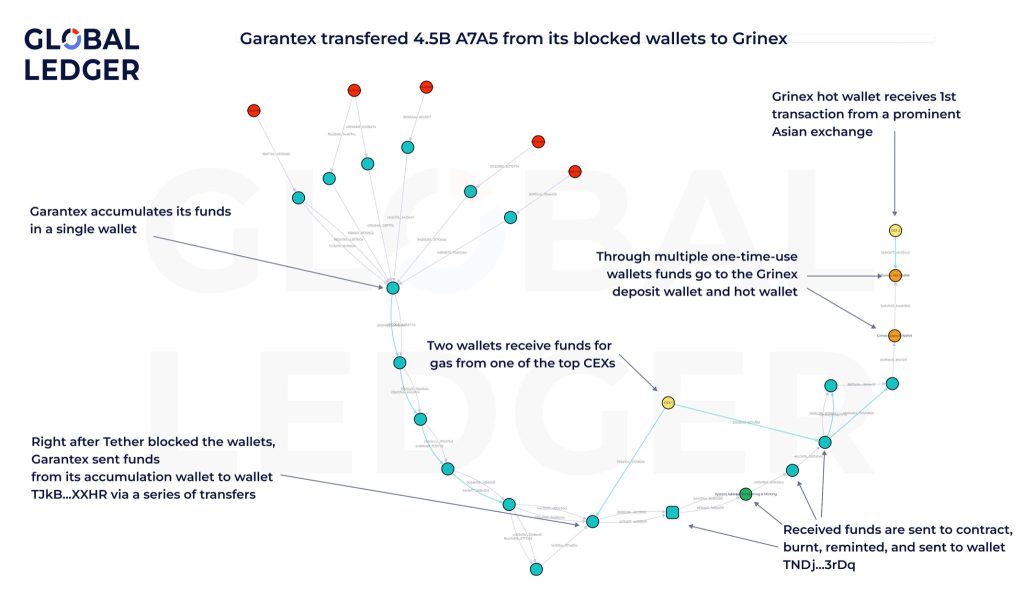

Blockchain tracing revealed that user funds, especially balances in the ruble-backed A7A5 stablecoin, were quietly transferred from Garantex wallets to Grinex controlled addresses. Global Ledger did an amazing work to publicly disclose their findings.

Investigations concluded that Grinex is a rebranded continuation of Garantex, effectively a ghost in the shell of the sanctioned exchange.

Sanctions Evasion in Web3: A growing threat

The Grinex case highlights a broader issue: bad actors in crypto can quickly shed their digital skins and return under new names. With decentralized infrastructure, borderless assets, and anonymous wallets, it is increasingly difficult for sanctions to enforce.

Exchanges like Garantex/Grinex exploit this by rebranding, redeploying code, and shifting liquidity across blockchain rails, faster than regulators can react.

The limits of sanctions in a decentralized ecosystem

While sanctions from entities like OFAC are powerful tools, their effectiveness has limitations in the blockchain environment. Here’s how:

What OFAC Can Do:

- Seize infrastructure: If domains or servers are hosted with U.S.-linked providers, they can be legally seized.

- Restrict market access: U.S. and EU sanctions cut off flagged exchanges from compliant financial systems and service providers.

- Pressure third parties: Hosting, payment gateways, email, and cloud service providers can be forced to drop support.

What OFAC Cannot Do:

- Stop on-chain transactions: Blockchains are decentralized and unstoppable by design.

- Freeze self custodies wallets: Without access to private keys or intermediary custodians, authorities can only flag addresses.

- Enforce inside non-cooperative jurisdictions: Russia and other regions may ignore U.S. or EU sanctions altogether.

How exchanges still get disrupted:

Even if Garantex reemerges as Grinex, its operations are hindered by isolation. Each rebrand leads to:

- Loss of trust among users

- Restricted access to stablecoins and major tokens

- Increased scrutiny from blockchain intelligence firms

Ultimately, rebranding becomes a tactic of diminishing returns. Exposure, disruption, and transparency can still weaken such platforms significantly, even if they remain technically operational.

How investigators track these moves

Despite the agility of rebranded actors, blockchain analytics tools and investigative techniques can still shine light into the shadows. Here are some key methods used to uncover the Grinex connection:

- Wallet heuristics: Grouping addresses by behaviour and transaction patterns.

- KYT (Know Your Transaction) systems: Flagging suspicious flows involving sanctioned entities.

- Clustering: Identifying wallets and nodes with shared infrastructure or metadata.

- UI/UX forensics: Reverse-engineering frontend and backend similarities.

- Domain WHOIS linking: Tracing common registrars or ownership overlaps.

Red flags to watch for

To help investigators and compliance professionals stay ahead, here are some common red flags of an exchange rebranding to evade sanctions:

- Recently registered domain with similarities to a sanctioned site

- Unexplained migration of user funds or stablecoins

- Identical or near-identical interface to a previously shut-down platform

- Marketing targeting the same regional demographics

- Reuse of customer service Telegram handles or emails

The bigger picture: Persistent surveillance in decentralized finance

The Garantex to Grinex transformation is a textbook case of sanctions evasion, and a wake-up call for regulators, investigators, and the crypto industry. Without persistent surveillance, agile threat actors will continue to exploit the borderless nature of crypto. Solutions require global cooperation, cutting-edge analytics, and a proactive approach to investigating both the infrastructure and the money flows that sustain these operations.

At BlockDefenders and VALEGA Chain Analytics, we remain committed to exposing these tactics and equipping investigators with the tools and insights needed to protect the integrity of the decentralized ecosystem.

Conclusion

The case of Garantex and its rapid transformation into Grinex underscores one of the core challenges facing modern crypto regulation: the tension between decentralization and enforcement. As digital finance continues to evolve, malicious actors are becoming more sophisticated in circumventing traditional sanctions and compliance mechanisms. While blockchain provides transparency, it also offers anonymity and agility, powerful tools in the hands of those who wish to exploit the system.

Even in a decentralized world, accountability is possible. Through relentless surveillance, public-private collaboration, and advanced analytics, it is increasingly difficult for bad actors to hide in plain sight. Every wallet connection, every smart contract redeploy, and every DNS record leaves a trail and diligent investigators can follow and report.

The fight against financial crime in the crypto space will not be won by regulators alone. It will require a fast pacing global coalition of cybersecurity experts, blockchain intelligence firms, ethical hackers, and policy leaders working together to protect digital infrastructure and economic integrity. Garantex may have changed its name, but it cannot outrun the reach of collective intelligence.

In the end, transparency remains crypto’s greatest weapon and, simultaneously, its greatest test. At BlockDefenders and VALEGA Chain Analytics, we stand ready to meet that challenge head-on.